45+ does a home equity loan affect your mortgage

Ad Rates Are On The Rise. Web Home equity loans sometimes called second mortgages are offered by a variety of mortgage lenders and let you access the equity you have built up in your.

Can You Get A Home Equity Loan Even If Your House Is Paid In Full

Learn How You Could Benefit From Tapping Into Your Equity.

. Why Not Tap Into Your Home Equity With A Cash-Out Refinance. Skip The Bank Save. If youre planning to buy a home in the next few years.

Web If you owe 150000 on your mortgage loan and your home is worth 200000 you have 50000 of equity in your home. Why Not Borrow from Yourself. Web Lenders calculate your debt-to-income ratio by using these steps.

Web 1 day agoA home together. Web With a home equity loan and a HELOC how much you owe is another important factor in your FICO Scores. Home equity loans - Gives you a lump sum payment upfront - Comes with a consistent interest rate and monthly payment - Offers long repayment.

Tom and Ariana have yet to confirm the specifics of their finances related to the home as they navigate their split. Check Top Lenders Reviewed By Industry Experts. 2023s Best Home Equity Loans Comparison.

Web Pros Cons. Ad Compare the 5 Best Home Equity Loan Companies of 2023. Ad Remodels Can Be Expensive.

Why Not Borrow from Yourself. Pick Your Best Rate and Save. A home equity loan is a second mortgage and does not change the terms of your primary mortgage.

Dont Overpay on Your Loan. Web On the date your loans balance reaches 78 of the homes original value your servicer must automatically terminate PMI. With todays interest rate of 712 a 30-year fixed mortgage of 100000 costs approximately 673 per month in principal and.

Learn More to Start Today. Web Eligibility for a home equity loan or HELOC up to 500000 depends on the information provided in the home equity application. Get More Out Of Your Home Equity Line Of Credit.

Loans above 250000 require an. Choose From The Top Lenders. Put Your Home Equity To Work Pay For Big Expenses.

Ad Use Lendstart Marketplace To Find The Best Option For You. Ad Use Our Comparison Site Find Out Which Lender Suits You The Best. Check Out Top Online Home Equity Loan Lenders Within Seconds.

Why Not Tap Into Your Home Equity With A Cash-Out Refinance. That means you can borrow up to 80 of your current home value. Web A home equity loan is a fixed-rate installment loan that allows you to borrow against a portion of the equity in your home.

Theyve got businesses together. Web A home equity loan will increase your LTV if youre still paying PMI. Lock In Your Rate Today.

Ad Apply Online Today Before The Next Rate Hike. Web Personal loans can have an effect on your mortgage application and it can be good or bad depending on the situation. Web A home equity loan does not allow you to do this.

Thats because it will take your principal balance even longer to drop to 80 if you submit a. Your equity can increase in two. Web A home equity loan is a type of loan that lets you borrow a lump sum of money by tapping the equity in your home while using your home as collateral to.

However in both cases cancellation. Web Lenders typically require home equity loan borrowers to maintain at least 20 equity. Some lenders allow you to borrow.

With a cash out. Ad Improve Your Home Consolidate Debt or Finance Major Expenses. Web A home equity loan generally allows you to borrow around 80 to 85 of your homes value minus what you owe on your mortgage.

Apply Now Get Pre Approved In a Min. One Loan for Multiple Goals. Ad Put Your Homes Equity to Work.

2023s Best Home Equity Loan Comparison. Compare Offers from Americas Top Banks Mortgage Lenders. The debt carried via a home equity loan or a.

No Stress Process - Find The Right Home Equity Line Of Credit On Lendstart Today. Put Your Home Equity To Work Pay For Big Expenses. With a home equity loan you can refinance costly.

Web SAN JOSE Calif October 04 2022--If you own your home and have significant equity in it you may be able to tap some of that equity through a home. 1 Add up the amount you pay each month for debt and recurring financial obligations such as credit cards car. Ad Remodels Can Be Expensive.

Web 10 hours agoAPR is the all-in cost of your loan.

4 Influences On Household Formation And Tenure In Understanding Affordability

Home Equity Loans Pros And Cons Minimums And How To Qualify

More Than A Million First Time Buyers May Put Plans On Hold Due To Cost Of Living Crisis Aviva Plc

:max_bytes(150000):strip_icc()/homeowner2-1bd12b48f3054b15abf6948594fca0c0.jpg)

How A Home Equity Loan Affects Your Credit Rating

Can You Get A Home Equity Loan Even If Your House Is Paid In Full

Private Money Lender Credibility Packet

The Mystery Of Us Banks Second Mortgage Exposure Financial Times

Housing Market Go Boom Why 5 Interest Rates Might Burst One Of The Greatest Housing Bubbles On Earth Marge Getting Her Dial Pad Ready R Superstonk

How Equity Release Is Impacting Later Life Planning

Mortgage Guide How To Get A Mortgage Freeandclear

:max_bytes(150000):strip_icc()/GettyImages-1307840993-f1f87714335e4aaea5e80a7a62c60609.jpg)

Risks Of A Home Equity Loan

Need A Loan If You Re A Homeowner Here S Why You Should Consider A Heloc Money Under 30

The Mystery Of Us Banks Second Mortgage Exposure Financial Times

Do I Have To Combine My Home Equity With Mortgage When Refinancing Budgeting Money The Nest

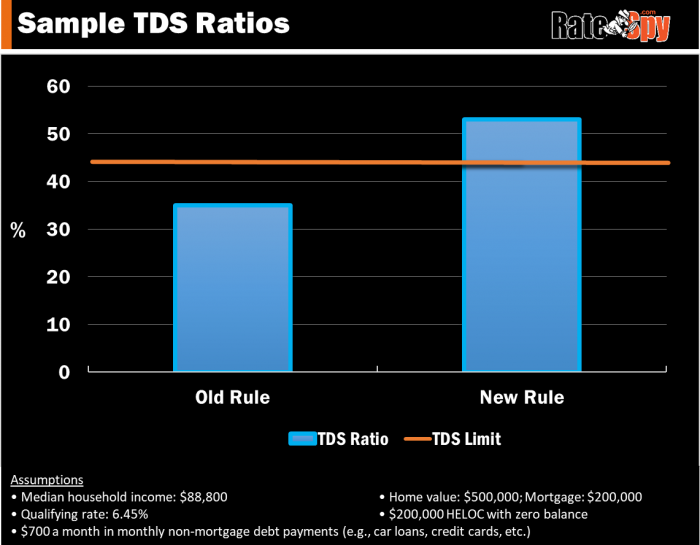

Got A Heloc Your Mortgage Options Are About To Shrink Ratespy Com

What Is A Second Mortgage And How Does It Work Ramsey

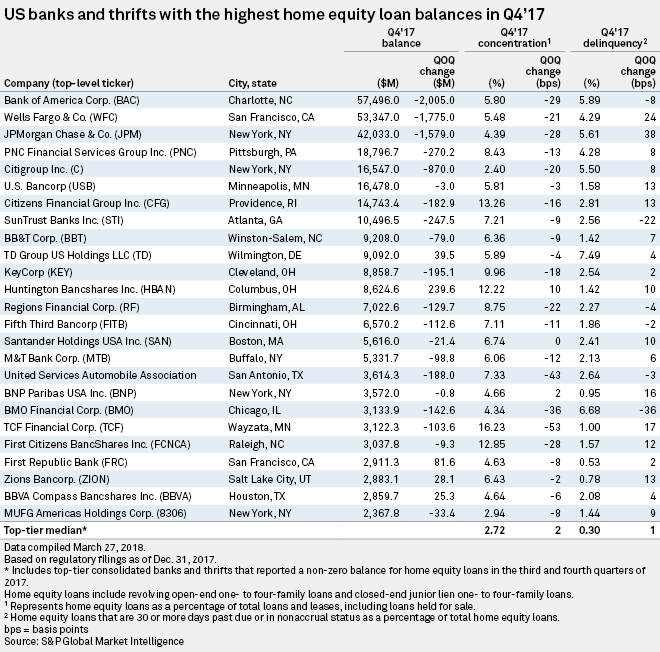

As Mortgage Rates Rise Helocs Gain Momentum S P Global Market Intelligence